SDA Insights - Specialist Disability Accommodation explained

Get eBook »

31 EOFY Tax and Superannuation Tips and Strategies FY2020 – COVID Edition Get eBook »

7 Things to know about SMSF Loans (plus Do’s and Don’ts)Get eBook »

Buying Property with Super - The Pros & Cons

Get eBook »

Ten trends that will affect retirement in AustraliaGet eBook »

Consolidating Your Super - The Ultimate Guide (and mistakes to avoid)Get eBook »

How Much Money Do I Need to Retire?Get eBook »

17 Government benefits all retirees should know about

Get eBook »

Understanding The Pension Loans SchemeGet eBook »

Financial Planning for Surgeons Get eBook »

A Teacher's Guide to Financial Planning Get eBook »

Top 12 Mistakes to Avoid When Setting Up an SMSFGet eBook »

What expert investors know about property auctions Get eBook »

How To Get The Best Price For Your Home Get eBook »

38 Tips & Insights for First Home Buyers Get eBook »

10 Steps to Managing Inheritance and New Wealth Get eBook »

7 Insights to Avoid a Ruined Retirement Get eBook »

19 Facts & Insights for Dealing with Redundancy Get eBook »

Divorce & Separation: A Financial Guide Get eBook »

Money & Marriage: A Guide to Domestic Financial Bliss Get eBook »

Financial planning & superannuation for same sex couples Get eBook »

Moving Across the Ditch - A Guide for NZ Migrants Get eBook »

Moving to The Land Down Under - South African Immigrants Get eBook »

Thriving Through the Immigration Experience Get eBook »

Moving to The Land Down Under - British Immigrants Get eBook »

Returning to Australia: an Expats Guide Get eBook »

Doctors Guide to Financial AdviceGet eBook »

How many properties do I need to retire? Get eBook »

7 Insurance Strategies to Manage Risk Get eBook »

Financial Health Check - 14 Questions You Should Ask Yourself Get eBook »

Top 26 End of Financial Year Tax & Superannuation Strategies Get eBook »

Top 13 Mistakes to Avoid with Granny FlatsGet eBook »

Top 13 Insights for High Net Worth Clients ($5m+)Get eBook »

How to Survive the Financial Crisis Get eBook »

Financial Planning for Australian Pilots Get eBook »

13 Strategy Insights into Positive Cash Flow Property Get eBook »

The Ultimate Guide to Mortgage Reduction Get eBook »

Planning a Career ChangeGet eBook »

Top 10 Blue Chip Brisbane Suburbs Get eBook »

How to Build a Multiple Property Portfolio Get eBook »

Property vs Shares: A new guide to an old question Get eBook »

The 11 Greatest NRAS Mistakes Not To Make! Get eBook »

How to Use NRAS to Create Positive Cashflow Investment Property Wealth Get eBook »

Top 13 Mistakes When Buying an Investment Property in Your SMSF Get eBook »

Renting vs Buying Get eBook »

Top 10 Strategies to pay for Private School Fees Get eBook »

Top 9 Things to Know About Salary Packaging and Mistakes to Avoid Get eBook »

6 Things to Understand About the Canberra Property Market Plus Top 5 Subrubs Get eBook »

Top 16 Ideas and Insights into AnnuitiesGet eBook »

8 Most Important Things to Know About my QSuper Get eBook »

Top 10 Mistakes to Avoid With Negative GearingGet eBook »

Top 23 Federal Budget Superannuation & Tax Changes Get eBook »

Top 10 Blue Chip Melbourne Suburbs Get eBook »

The Ultimate Guide to Company Compliance Get eBook »

Guide to Refinancing Get eBook »

How to Find a Good (and Right) Financial Planner for You Get eBook »

Top 10 Things to Know about VicSuperGet eBook »

10 Points to Consider When Selling Your Business Get eBook »

Your guide to SMSF Property Loans Get eBook »

Top 13 Strategies to Reduce Your Capital Gains Tax - for Property Investors Get eBook »

Guide to Buying an Apartment Get eBook »

How to use your SMSF to buy NRAS property Get eBook »

15 Tax and Investment Mistakes to Avoid for SMSF Direct Share Investors Get eBook »

23 Transition to Retirement Strategy Insights Get eBook »

Your Guide to Establishing and Operating a Self Managed Super Fund Get eBook »

Top 18 Pros and Cons of Testamentary TrustsGet eBook »

Top 16 Strategies and Insights to Help Your Adult Children into the Property MarketGet eBook »

Tax Deductions for Property Investors: A Quick Guide Get eBook »

Property Research Secrets Get eBook »

Self Managed Super Fund vs Small APRA Fund Get eBook »

7 Steps to Financial FreedomGet eBook »

Understanding the Living Away From Home Allowance Get eBook »

13 decision making mistakes that investors make...and how to avoid themGet eBook »

Understanding The Pension Loans Scheme Get eBook »

17 Government benefits all retirees should know aboutGet eBook »

Understanding Group vs Retail Life InsuranceGet eBook »

Renting Out Your Family Home: Implications for When You Move into Aged CareGet eBook »

ETFs, LICs and Unlisted Managed Funds – What’s the difference?Get eBook »

35 End of Financial Year Tax & Superannuation Tips & Strategies – FY2021 EditionGet eBook »

Understanding Insurance Jargon Plus 5 Things To ConsiderGet eBook »

Your Guide To Buying Off PlanGet eBook »

How to Buy Commercial Property in an SMSFGet eBook »

Top 15 Super and Tax StrategiesGet eBook »

Top 10 Estate Planning Mistakes to AvoidGet eBook »

Is Your Nest Egg Safe?Get eBook »

Financial Planning for Professional AthletesGet eBook »

Financial Planning and Superannuation for WomenGet eBook »

The Benefits of Investing in Australian Residential PropertyGet eBook »

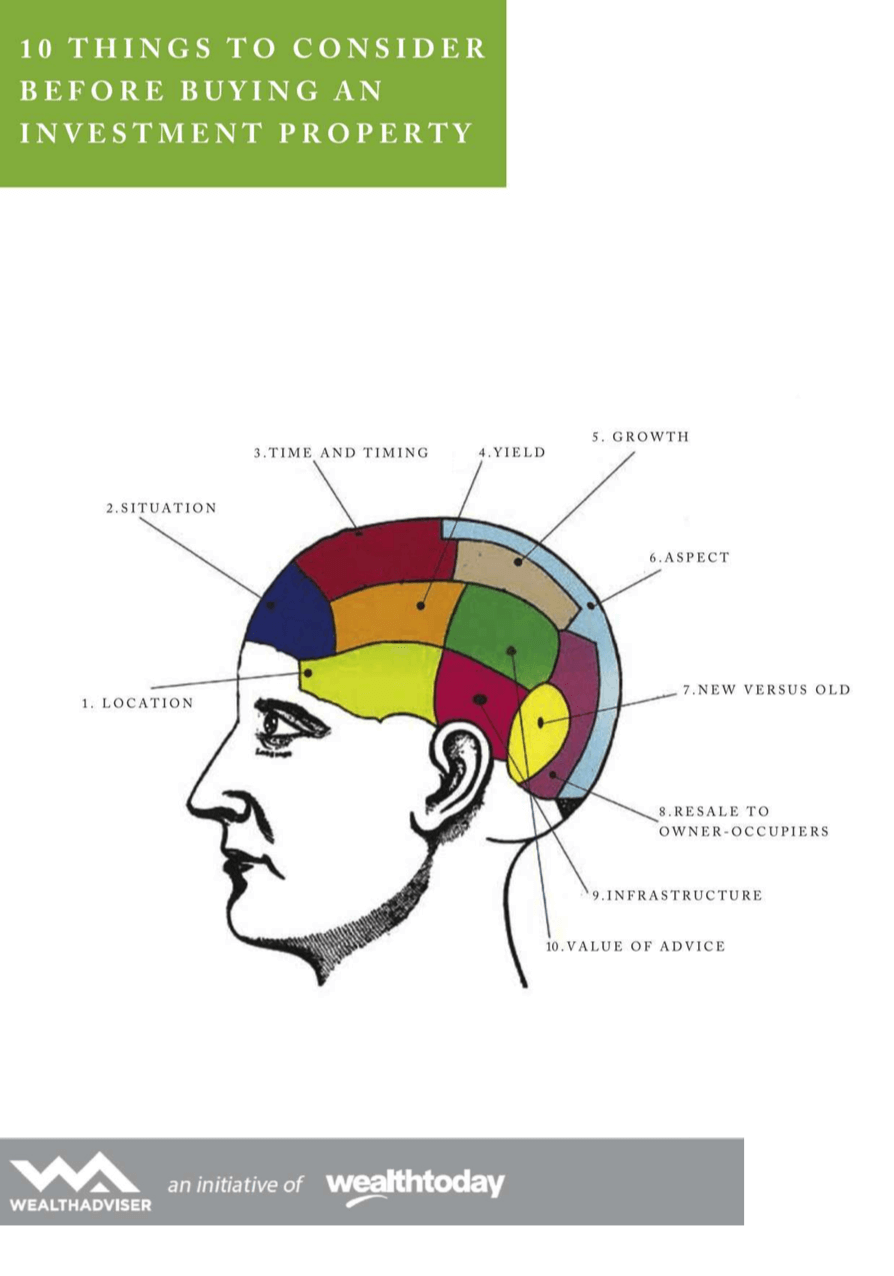

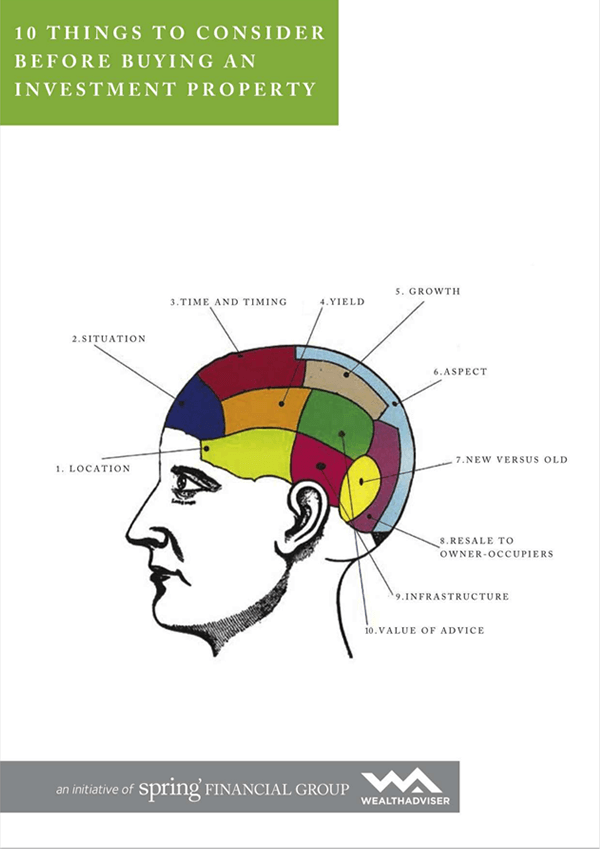

10 Things to Consider Before Buying an Investment Property Get eBook »

The Top 15 Pros & Cons of Defence HousingGet eBook »

Top 6 Things You Should Know About The Div 293 Tax Get eBook »

Downsizing - 13 Insights to Improve Your Thinking on the SubjectGet eBook »

Top 7 Mistakes When Choosing a Financial Planner Get eBook »

Taxation of Employee Share SchemesGet eBook »

Top 21 Insights Into Negative Gearing Plus Mistakes To Avoid Get eBook »

How To Transfer Your UK Pension (QROPS)Get eBook »

The Ultimate Guide to LRBAs Get eBook »

Top 11 Family Trust Mistakes not to MakeGet eBook »

Budgeting The Ultimate Guide Get eBook »

Rentvesting: Your guide to why, when, where and how Get eBook »

Introduction to SMSFs Get eBook »

SMSF Trustee Responsibilities Get eBook »

Getting Money into Super Get eBook »

Withdrawing Money From Super Get eBook »

SDA Investment Insights - Specialist Disability Accommodation explainedGet eBook »

31 End of Financial Year Tax and Superannuation Tips and Strategies FY2020 – COVID EditionGet eBook »

Top 15 Super and Tax StrategiesGet eBook »

How to Build a Multiple Property Portfolio Get eBook »

Your Guide to Establishing and Operating a Self Managed Super Fund Get eBook »

Financial Planning & Superannuation for Women Get eBook »

Top 10 Things to Know about VicSuperGet eBook »

Introduction to SMSFs Get eBook »

SMSF Trustee ResponsibilitiesGet eBook »

Property vs Shares: A new guide to an old question Get eBook »

Tax Deductions for Property Investors: A Quick Guide Get eBook »

Top 21 Insights Into Negative Gearing Plus Mistakes To Avoid Get eBook »

Contributing to SuperannuationGet eBook »

Withdrawing Money From SuperannuationGet eBook »

SMSF Investment RulesGet eBook »

Taxation of SMSFsGet eBook »

Winding an SMSF UpGet eBook »

Top 26 End of Financial Year Tax & Superannuation Strategies - 2017 Get eBook »

The Ultimate Guide to Company Compliance Get eBook »

The Ultimate Guide to LRBAs Get eBook »

Top 6 Things You Should Know About the Div 293 TaxGet eBook »

How much money do I need to retire?Get eBook »

Top 13 Mistakes When Buying an Investment Property in Your SMSF Get eBook »

Property Research Secrets Get eBook »

Planning a Career ChangeGet eBook »

Financial Health Check- 14 Questions You Should Ask Yourself Get eBook »

Doctors Guide to Financial AdviceGet eBook »

7 Steps to Financial Freedom Get eBook »

Self Managed Super Fund vs Small Area Fund Get eBook »

19 Facts & Insights for Dealing with Redundancy Get eBook »

2017 Superannuation Reform - What this means for youGet eBook »

Taxation of Employee Share SchemesGet eBook »

Top 10 Mistakes to Avoid When Setting Up an SMSF Get eBook »

Top 10 Mistakes to Avoid With Negative Gearing Get eBook »

Top 11 Family Trust Mistakes Not to Make Get eBook »

The Ultimate Guide to Mortgage Reduction Get eBook »

Your Guide To Buying Off Plan Get eBook »

Top 10 Estate Planning Mistakes to Avoid Get eBook »

6 Things to Understand About the Canberra Property MarketGet eBook »

Top 9 Things to Know About Salary Packaging and Mistakes to Avoid Get eBook »

Top 18 Pros and Cons of Testamentary Trusts Get eBook »

Divorce & Separation: A Financial Guide Get eBook »

Moving to The Land Down Under - British Immigrants Get eBook »

Your guide to SMSF Property Loans Get eBook »

15 Tax and Investment Mistakes to Avoid for SMSF Direct Share Investors Get eBook »

Top 10 Strategies to pay for Private School Fees Get eBook »

Top 16 Ideas and Insights into Annuities Get eBook »

How to Buy Commercial Property in a SMSF Get eBook »

Is Your Nest Egg Safe? Get eBook »

The Benefits of Investing in Australian Residential Property Get eBook »

How many properties do I need to retire? Get eBook »

How to Survive the Financial Crisis Get eBook »

Top 13 Insights for High Net Worth Clients ($5m+)Get eBook »

The Ultimate Guide to Budgeting Get eBook »

How to Use NRAS to Create Positive Cashflow Investment Property Wealth Get eBook »

How to use your SMSF to buy NRAS property Get eBook »

Guide to Refinancing Get eBook »

Guide to Buying an Apartment Get eBook »

Top 13 Strategies to Reduce Your Capital Gains Tax - for Property Investors Get eBook »

232 Transition to Retirement Strategy InsightsGet eBook »

14 Best Sydney Suburbs to Buy an Investment Property Get eBook »

13 Strategy Insights into Positive Cash Flow Property Get eBook »

Top 10 Blue Chip Brisbane Suburbs Get eBook »

Top 10 Blue Chip Melbourne Suburbs Get eBook »

The Top 15 Pros & Cons of Defence Housing Get eBook »

8 Most Important Things to Know About My QSuperGet eBook »

Top 7 Mistakes When Choosing a Financial Planner Get eBook »

Rentvesting: Your guide to why, when, where and howGet eBook »

How to Find a Good (and Right) Financial Planner for You Get eBook »

The 11 Greatest NRAS Mistakes Not To Make! Get eBook »

7 Insurance Strategies to Manage Risk Get eBook »

Financial Planning for Australian PilotsGet eBook »

Ten Points to Consider When Selling Your BusinessGet eBook »

10 Things to Consider Before Buying an Investment PropertyGet eBook »

Financial Planning for Surgeons Get eBook »

What expert investors know about property auctions Get eBook »

Renting vs Buying Get eBook »

A Teacher's Guide to Financial Planning Get eBook »

10 Steps to Managing Inheritance and New Wealth Get eBook »

38 Tips & Insights for First Home Buyers Get eBook »

How To Get The Best Price For Your Home Get eBook »

7 Insights to Avoid a Ruined Retirement Get eBook »

Money & Marriage: A Guide to Domestic Financial Bliss Get eBook »

Moving Across the Ditch - A Guide for NZ Migrants Get eBook »

Returning to Australia: an Expats Guide Get eBook »

Financial planning & superannuation for same sex couples Get eBook »

Top 23 Budget Superannuation & Tax Changes Get eBook »

Top 16 Strategies and Insights to Help Your Children into the Property Market Get eBook »

Downsizing - 13 Insights to Improve Your Thinking on the SubjectGet eBook »

Moving to The Land Down Under - South African Immigrants Get eBook »

Thriving Through the Immigration Experience Get eBook »

Top 13 Mistakes to Avoid with Granny Flats Get eBook »